Insights

Transform your investment strategy with Level: Solutions for every financing and support organisation

Oct 8, 2024

Transform Your Investment Strategy with Level: Tailored Solutions for Every Client Segment

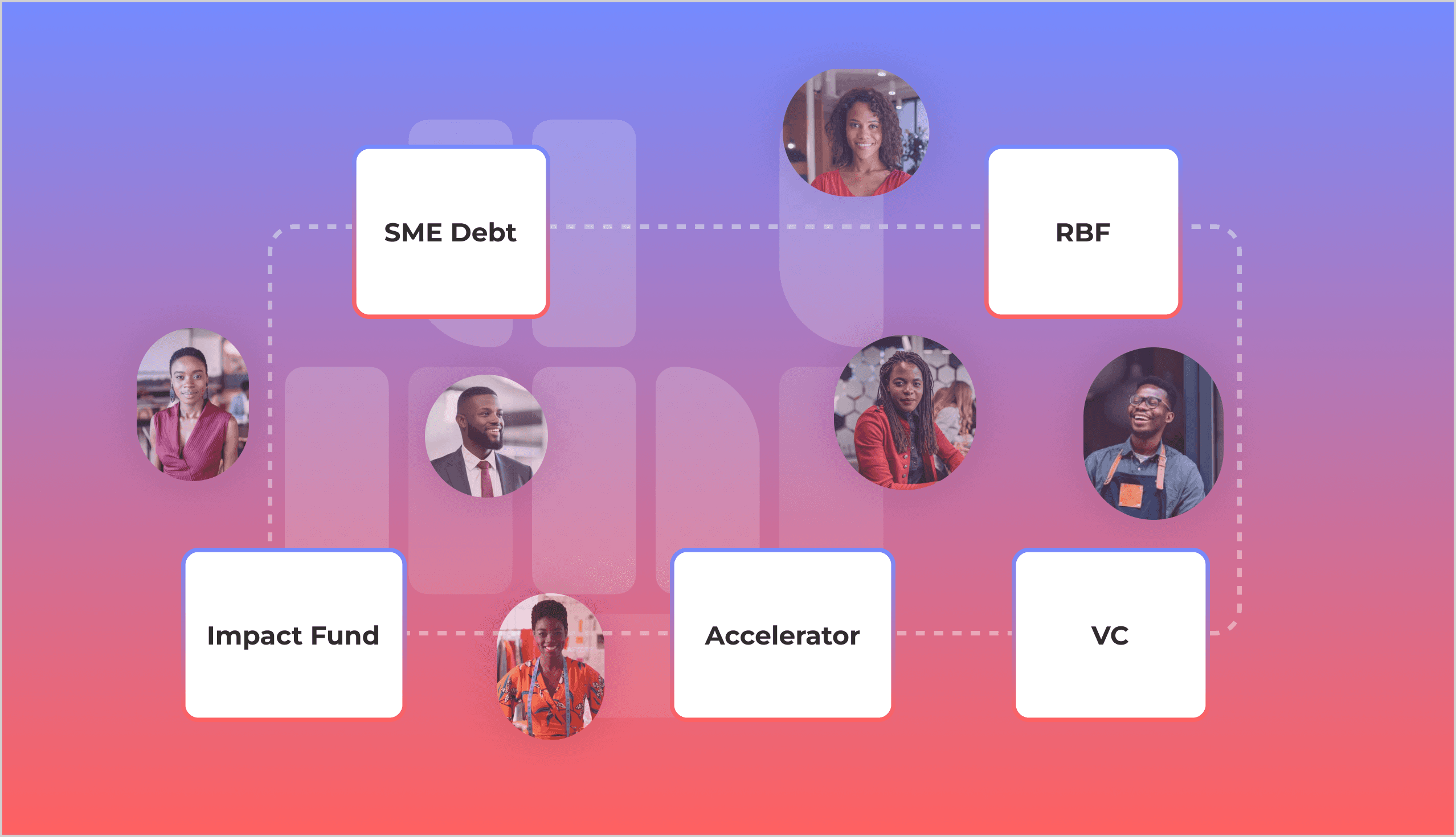

At Level, we understand that every investment strategy has unique challenges. Whether you're an SME debt investor, running an accelerator program, or managing a venture capital or impact fund, our platform is designed to streamline your processes, enhance decision-making, and centralize data for better results. Level allows you to flexibly configure your financing instruments, create Due Diligence processes tailored to each of them, and structure your Portfolio Monitoring accordingly.

Here’s a quick overview of how Level can help you elevate your operations:

Solutions for SME Debt Investors

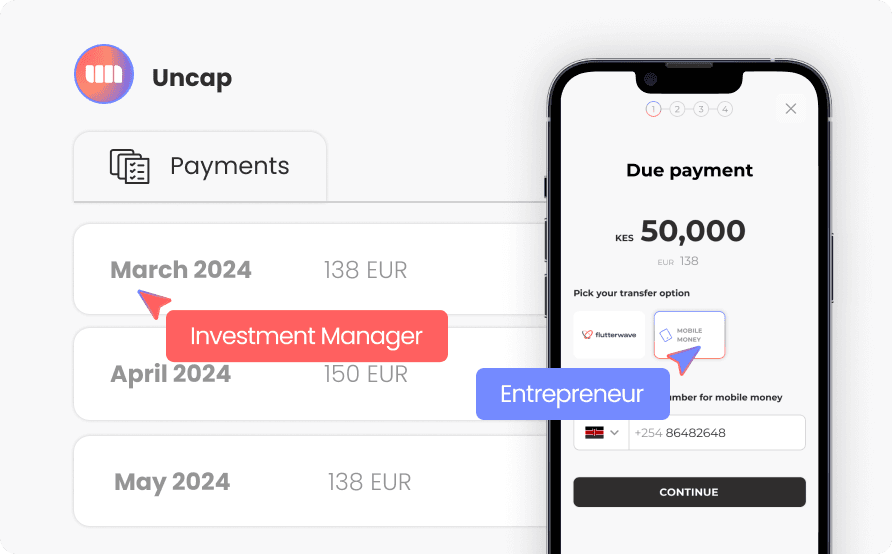

For SME debt investors, manual loan origination, document verification, data entry, and inconsistent risk assessments can hinder your success. Level’s streamlined loan processing speeds up approvals and centralizes loan data, allowing you to focus on growing your portfolio more efficiently.

Pain Point: Lengthy manual processes, inconsistent risk assessment, and fragmented data management.

Solution: Automated workflows, API-driven risk assessments, and centralized data and payment collection.

Feature Highlight: Automated calculation of amortisation schedules with automated Invoicing.

Solutions for Revenue-Based Financing (RBF)

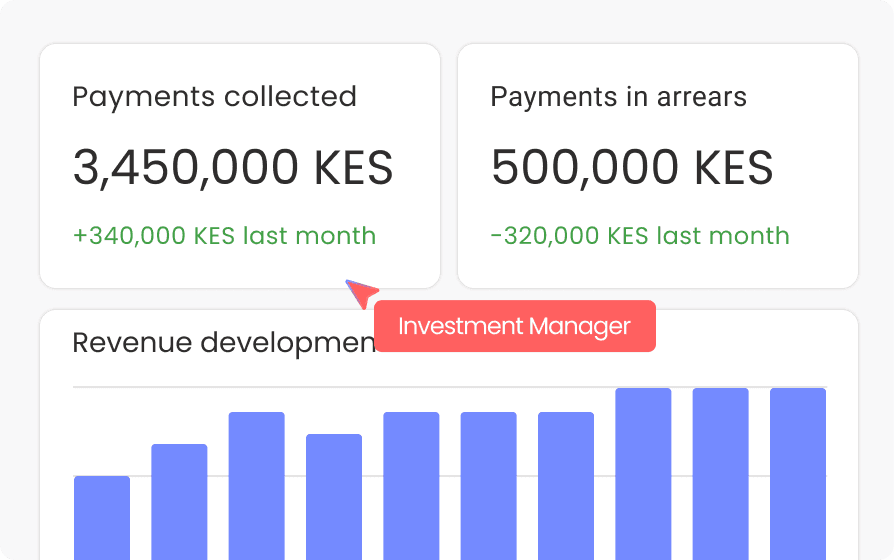

Managing complex funding workflows and tracking revenue performance create operational burden. With Level’s real-time analytics and streamlined funding processes, your RBF operations become more efficient, providing accurate insights and streamlined collections.

Pain Point: Complex workflows and lack of real-time insights into portfolio revenues.

Solution: Simplified funding processes, real-time portfolio insights, and standardized metrics.

Feature Highlight: Build your own RBF product and validate revenues with bank account statement analysis.

Solutions for Accelerator Programs

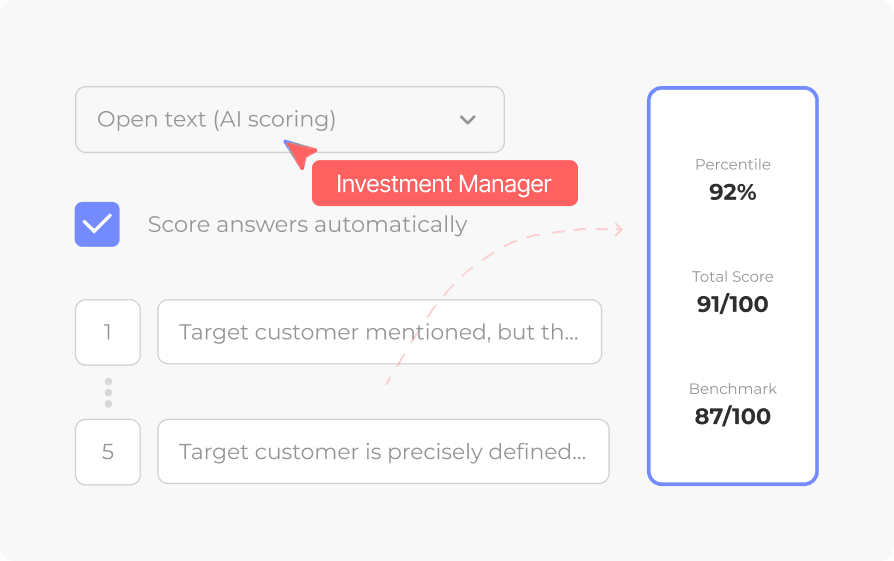

Screening applicants and managing large volumes of data can slow down your accelerator program. With Level’s AI-powered screening and data-driven selection processes, you can identify high-potential entrepreneurs in a fair and efficient manner.

Pain Point: Manual screening and selection biases.

Solution: Automated screening and de-biased selection processes.

Feature Highlight: AI-enabled scoring mechanism to accelerate and de-bias screening

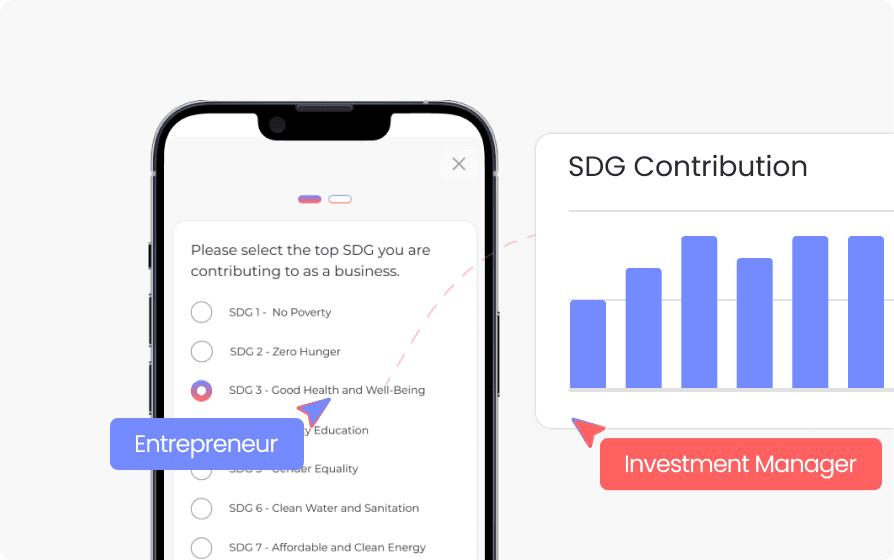

Solutions for Impact Funds

For impact funds, quantifying and reporting social and environmental returns can be challenging. Level’s impact measurement tools help you track aligned metrics, ensuring transparency and ease of reporting.

Pain Point: Challenges in impact measurement and fragmented data systems.

Solution: AI-driven screening, integrated impact metrics, and centralized data management.

Feature Highlight: Automatically collect impact metrics whenever you need them.

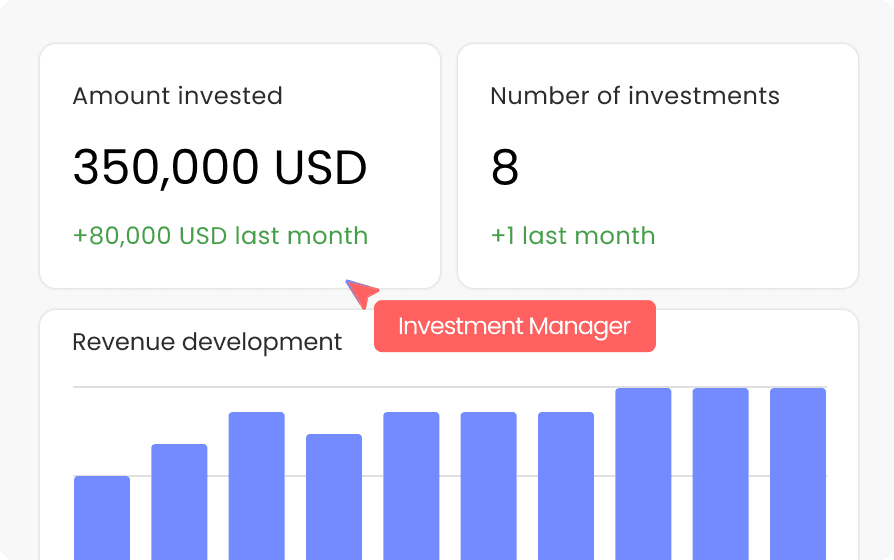

Solutions for VCs

VCs often deal with bottlenecks in due diligence and time-consuming reporting. Level's automated tools accelerate your due diligence, integrate data from multiple sources, and simplify reporting to LPs, saving you time and resources.

Pain Point: Slow due diligence, complex data integration, and time-consuming reporting.

Solution: Efficient workflows, comprehensive data integration, and automated reporting.

Feature Highlight: Track your investment data bridging deal flow and portfolio management to ensure robust data structures.

At Level, we empower you with the tools and insights needed to drive better decisions and streamline your operations. Whether you're investing in startups, running support structures, or managing loans, Level’s platform adapts to your needs, making complex processes simple and efficient.

Ready to see how Level can elevate your investment strategy? Book a demo today and discover the difference.